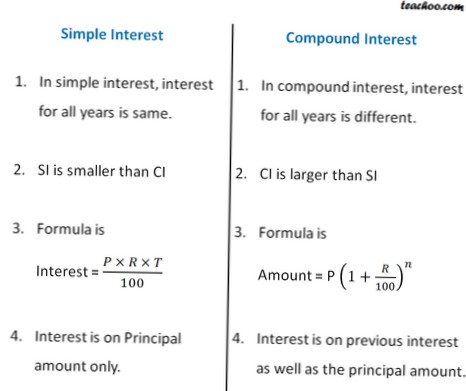

Simple interest is calculated on the principal, or original, amount of a loan. Compound interest is calculated on the principal amount and also on the accumulated interest of previous periods, and can thus be regarded as "interest on interest."

- What is the difference between simple interest and compound interest Why do you end up with more money with compound interest?

- What is the difference between simple and compound interest quizlet?

- How do you calculate simple and compound interest?

- What is the difference between compound interest and simple interest for 2 years?

- How do I calculate compound interest annually?

- How do I calculate interest?

- Why does compound interest earn more money than simple interest?

- What are the similarities and differences between simple interest and compound interest?

- What is simple interest and example?

- What is an example of compound interest?

- Do banks use simple interest or compound interest?

What is the difference between simple interest and compound interest Why do you end up with more money with compound interest?

Why do you end up with more money with compound interest? Simple interest is interest paid only on the original investment whereas compound interest paid both on the original investment and on all interest that has been added to the original investment.

What is the difference between simple and compound interest quizlet?

What is the difference between compound and simple interest? simple interest is the money you earn on deposits in the bank. Compound interest is interest that's paid on what you deposit in the bank + interest on your interest.

How do you calculate simple and compound interest?

There are two ways a financial institution will calculate interest: simple or compound.

- Simple interest is calculated using only the principal amount of the loan.

- Compound interest is calculated using the principal amount of the loan, plus the interest that has accumulated over previous periods.

What is the difference between compound interest and simple interest for 2 years?

The difference between compound interest and simple interest for 2 years is 631. So, the value of the investment is $63100. Example 2 : ... The rate of interest is same for both compound interest and simple interest and it is compounded annually.

How do I calculate compound interest annually?

A = P(1 + r/n)nt

- A = Accrued amount (principal + interest)

- P = Principal amount.

- r = Annual nominal interest rate as a decimal.

- R = Annual nominal interest rate as a percent.

- r = R/100.

- n = number of compounding periods per unit of time.

- t = time in decimal years; e.g., 6 months is calculated as 0.5 years.

How do I calculate interest?

Calculation: You can calculate your total interest by using this formula: Principal Loan Amount x Interest Rate x Time (aka Number of Years in Term) = Interest.

Why does compound interest earn more money than simple interest?

Compound interest makes a sum of money grow at a faster rate than simple interest, because in addition to earning returns on the money you invest, you also earn returns on those returns at the end of every compounding period, which could be daily, monthly, quarterly or annually.

What are the similarities and differences between simple interest and compound interest?

While both types of interest will grow your money over time, there is a big difference between the two. Specifically, simple interest is only paid on principal, while compound interest is paid on the principal plus all of the interest that has previously been earned.

What is simple interest and example?

Generally, simple interest paid or received over a certain period is a fixed percentage of the principal amount that was borrowed or lent. For example, say a student obtains a simple-interest loan to pay one year of college tuition, which costs $18,000, and the annual interest rate on the loan is 6%.

What is an example of compound interest?

One compound interest example from Ryan: Let's say Sarah, age 20, invested $1,000 today. If she didn't touch it until she retired at age 70, her money could increase by 32 times — meaning she could end up with around $32,000.

Do banks use simple interest or compound interest?

Banks may use both depending on the tenure and the amount of the deposit. What is the difference between the two? With simple interest, interest is earned only on the principal amount. With compound interest, the interest is earned on the principal as well as the interest.

Differbetween

Differbetween